does maryland have a child tax credit

2 days agoTax reform. CASH Campaign of Maryland 410-234-8008 Baltimore Metro Comptroller of Maryland 1-800-MD-TAXES 1-800-638-2937 To find a Volunteer Income Tax Assistance VITA site offering free tax prep in your area call 410-685-0525 or 1.

Maryland Homeowners Overtaxed Millions Of Dollars

Starting as soon as July most families with.

. The Child Tax Credit has been expanded to reach additional children in Maryland many of whom are in families that do not realize theyre eligible for these funds. Every child deserves a chance to grow up free from hunger free from poverty and able to access the best care and education available. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the requirements for claiming the Child Tax Credit.

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767-5915. The rest of the tax credit worth between. For a period not to exceed 10.

All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of six and raised the age limit from 16 to 17. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

Center_Content Human Trafficking GET HELP. Filing requirements Created Date. House majority leader and represents Marylands 5 th.

This money is not a loan. Through December 2021 thousands of Maryland families recieved monthly payments deposited directly into their bank accounts of up to 300 per child under age 6 and up to 250 per child from ages 6 to 17. E-File Directly to the IRS.

Does Maryland have a dependent care tax credit for parents. Tax Year 2020 2021 2022. The enhanced child tax credit will help so many families and children in Maryland.

Tax Credits and Deductions for Individual Taxpayers. 311 West Saratoga Street Baltimore MD 21201. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6 years old.

Maryland taxpayers will receive payments of 300 per month for children up to age 5 and 250 for children age 6 to 17. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child between ages 6 and 17 per year. For roughly 39 million households covering 88 of children in the United States the monthly checks will be automatic according to the Internal Revenue Service.

The writer a Democrat is the US. That will send families up to 250 a month for every child between 6 and 17 years old and up to 300 a month for kids under 6. Researchers say it could have a.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. While not everyone took advantage of the payments which started in July 2021 and.

Yes see below for more information Parent Child Care Tax Credit Description Effective July 1 2019 state legislation was enacted to increase the maximum income limit on eligibility for the State income tax for child and dependent care expenses alter the phase-out. Each household could receive up to 3600 for each child under 6 years old and up to 3000 for each child between 6 and 17 years old. The First-Time Homebuyer Savings Account Subtraction may be claimed on Form 502SU by a Maryland resident who has not owned or purchased either individually or jointly a home in the State in the last 7 years and who has contributed money to a first-time homebuyer savings account.

Home of the Free Federal Tax Return. 1-800-332-6347 TTY 1-800-735-2258 2022 Marylandgov. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000.

In May 2019 Governor Larry Hogan R signed legislation to significantly increase the size of the states Credit for Child and Dependent Care Expenses expand the income limits and make the credit refundable for single filers with incomes. The enhanced Child Tax Credit helped provide Maryland families with a total of 3600 for each child under 6 and 3000 total for each child. Congressman Jamie Raskin MD-08 today announced that the expanded and improved Child Tax Credit may help 110500 children in Marylands 8 th District by providing families with regular monthly payments throughout the year to help with the costs of food child care diapers healthcare clothing and more.

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

Child Tax Credit Schedule 8812 H R Block

Tax Credit Available For Families With Children Dhs News

Tax Credit Available For Families With Children Dhs News

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Which States Could Receive Up To 750 Marca

Tax Credit Station North Arts District

General Assembly Passes 61 Billion Budget As Top Leaders Gather To Sign Tax Breaks Into Law Maryland Matters

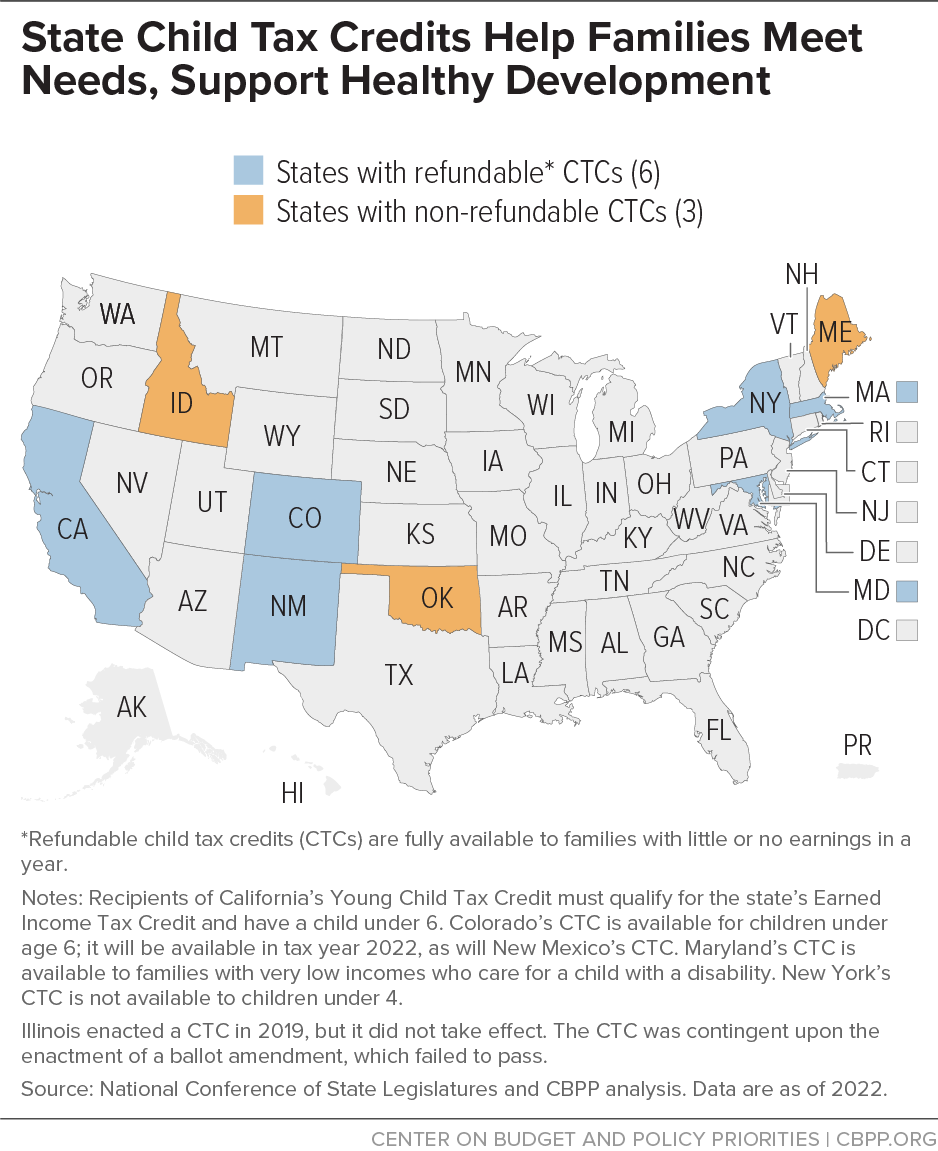

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Maryland Homecredit Program Lender Information

Maryland Improves Its Child And Dependent Care Tax Credit To Help More Families National Women S Law Center

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

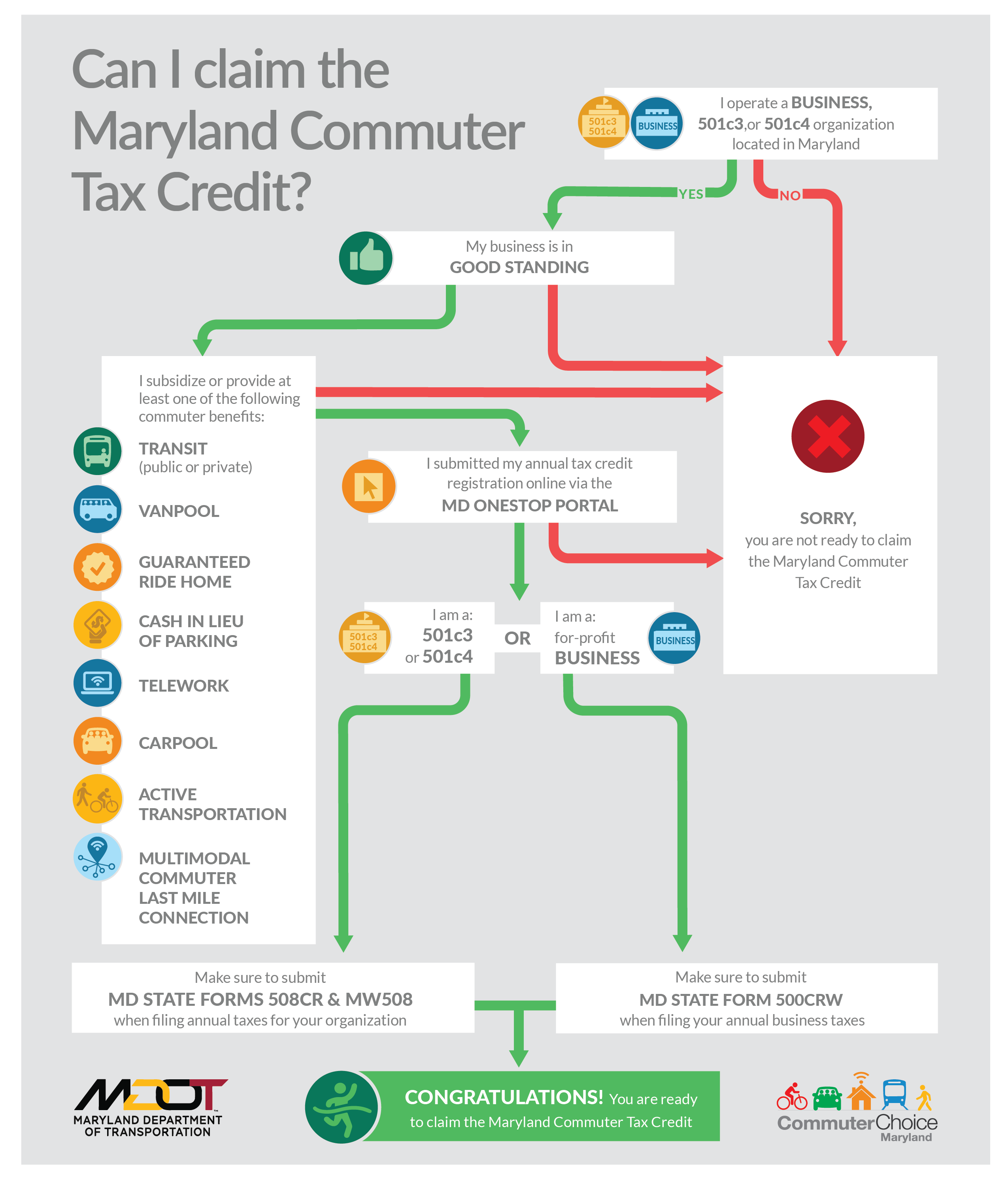

Maryland Commuter Tax Credit Mdot

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Child Tax Credit 2022 How Much Is The Child Support In These 10 States Marca